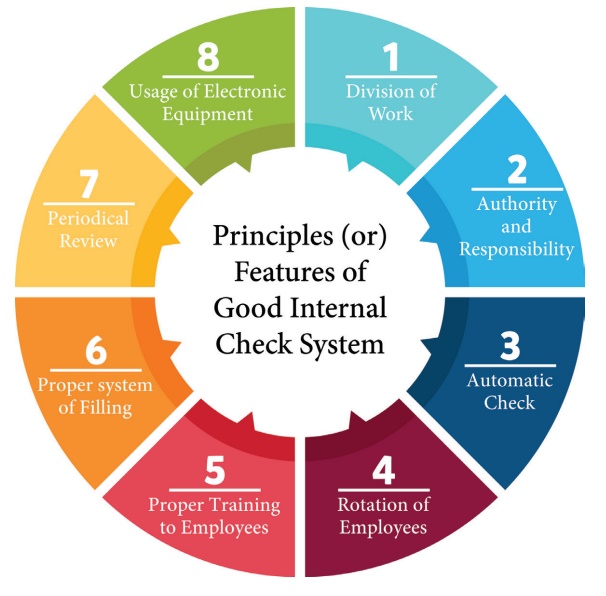

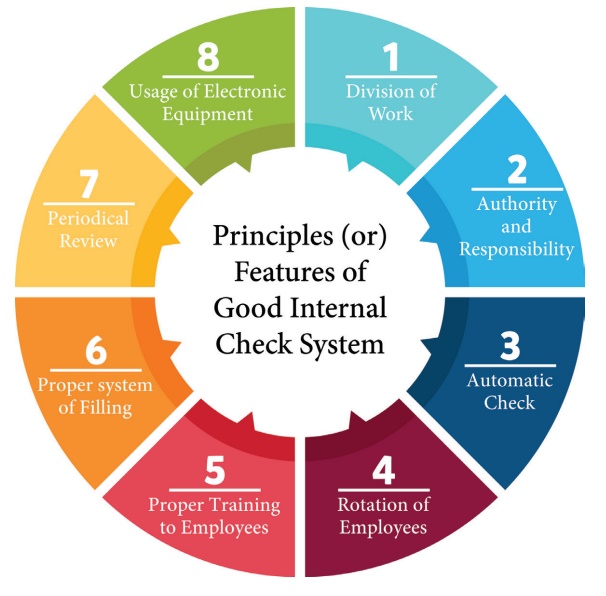

Features or characteristics of internal check systems

Internal check systems, also known as internal control systems, are designed to safeguard an organization's assets, ensure the accuracy of financial information, and promote operational efficiency.

Here are key features or characteristics of effective internal check systems:

-

Segregation of Duties:

- Assigning different responsibilities to different individuals helps prevent fraud and errors. For example, the person responsible for authorizing transactions should be different from the person responsible for recording them.

-

Authorization and Approval Procedures:

- Clearly defined procedures for authorizing and approving transactions ensure that only legitimate and approved activities take place. This includes approvals for expenditures, access to sensitive information, and changes to critical processes.

-

Physical Controls:

- Implementing physical controls such as locks, access cards, and security measures helps protect physical assets from theft, damage, or unauthorized access.

-

Documented Policies and Procedures:

- Having well-documented policies and procedures ensures that employees understand their roles and responsibilities. It also provides a reference for consistent and standardized operations.

-

Regular Reconciliations:

- Regular reconciliations of financial records, bank statements, and inventory help identify discrepancies and errors promptly, allowing for timely correction.

-

Internal Audits:

- Internal audits involve the periodic review of the organization's processes and controls. This helps assess the effectiveness of internal checks and identifies areas for improvement.

-

Employee Training and Awareness:

- Providing training to employees on internal controls and the importance of compliance helps create a culture of accountability and awareness.

-

IT Controls:

- With increasing reliance on information technology, effective IT controls are crucial. This includes access controls, encryption, and regular IT security assessments to protect against unauthorized access and data breaches.

-

Management Oversight:

- Active involvement of management in overseeing internal controls is essential. Management should regularly review reports, participate in audits, and demonstrate a commitment to a strong control environment.

-

Exception Reporting:

- Systems that generate exception reports highlight unusual or suspicious activities, allowing management to investigate and address potential issues promptly.

-

Monitoring and Feedback:

- Continuous monitoring and feedback mechanisms ensure that internal controls remain effective and relevant. Regular feedback loops help in identifying and addressing weaknesses in the system.

-

Risk Assessment:

- Conducting regular risk assessments helps identify potential threats and vulnerabilities, allowing organizations to tailor their internal controls to specific risks.

-

Contingency Planning:

- Effective internal check systems include contingency plans for unforeseen events, such as natural disasters or system failures, to minimize disruptions to operations.

-

Ethical Standards:

- Promoting ethical standards and a strong ethical culture within the organization is vital. Employees should understand the importance of integrity and compliance with established policies.

-

Feedback and Continuous Improvement:

- An internal check system should include mechanisms for feedback from employees, audits, and external assessments. Continuous improvement based on feedback helps adapt to changing circumstances and risks.

An effective internal check system is a comprehensive and dynamic framework that adapts to the evolving needs and risks of the organization. It requires a commitment from all levels of the organization to create a strong internal control environment.

Thank you.