Financial Management

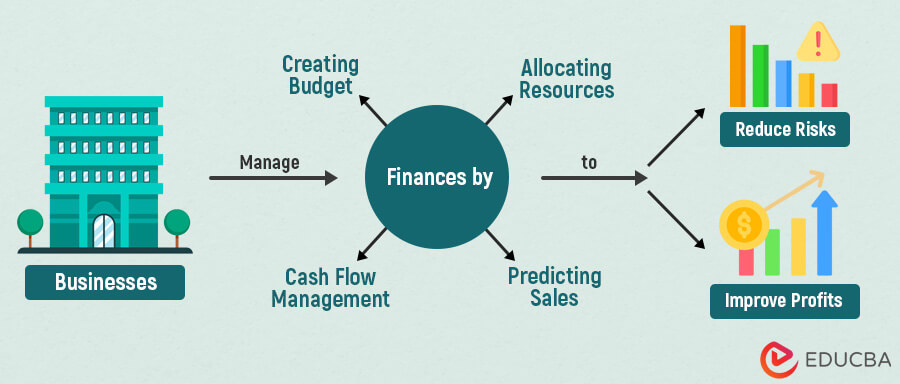

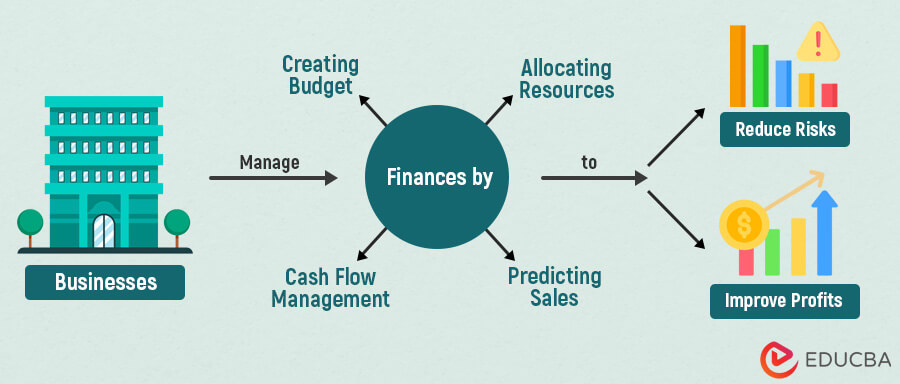

Financial management involves the strategic planning, organizing, directing, and controlling of an organization's financial activities to achieve its financial objectives effectively and efficiently. It encompasses a wide range of functions and responsibilities aimed at maximizing shareholder wealth and ensuring the long-term sustainability of the business. Here are some key aspects of financial management:

-

Financial Planning and Analysis:

- Developing comprehensive financial plans and budgets that align with the organization's strategic goals and objectives.

- Conducting financial analysis and forecasting to assess future financial performance and identify areas for improvement.

-

Capital Budgeting and Investment Decisions:

- Evaluating potential investment opportunities and capital projects to allocate financial resources effectively.

- Using techniques such as net present value (NPV), internal rate of return (IRR), and payback period to assess the viability and profitability of investment options.

-

Capital Structure Management:

- Determining the optimal mix of debt and equity financing to fund operations and growth initiatives while minimizing the cost of capital.

- Managing debt levels, interest rates, and credit ratings to maintain financial stability and liquidity.

-

Financial Risk Management:

- Identifying, assessing, and mitigating financial risks such as market risk, credit risk, liquidity risk, and operational risk.

- Implementing risk management strategies, such as hedging, diversification, and insurance, to protect against adverse events and uncertainties.

-

Working Capital Management:

- Managing short-term assets and liabilities to ensure sufficient liquidity for day-to-day operations.

- Optimizing cash flow, inventory levels, accounts receivable, and accounts payable to minimize financing costs and maximize profitability.

-

Financial Reporting and Compliance:

- Preparing accurate and timely financial statements in accordance with accounting standards and regulatory requirements.

- Ensuring compliance with tax laws, financial regulations, and reporting obligations imposed by regulatory authorities and stakeholders.

-

Financial Performance Monitoring:

- Monitoring key financial metrics and performance indicators to track the organization's financial health and performance.

- Conducting variance analysis and performance reviews to identify deviations from targets and implement corrective actions.

-

Stakeholder Relations and Communication:

- Building strong relationships with stakeholders, including investors, lenders, shareholders, and regulatory bodies.

- Communicating financial information, performance updates, and strategic initiatives effectively to internal and external stakeholders.

Overall, effective financial management is essential for achieving organizational objectives, maintaining financial stability, and creating long-term value for shareholders and stakeholders. By adopting sound financial management practices and strategies, organizations can enhance their competitiveness, mitigate risks, and seize opportunities for growth and expansion.

Thank you,