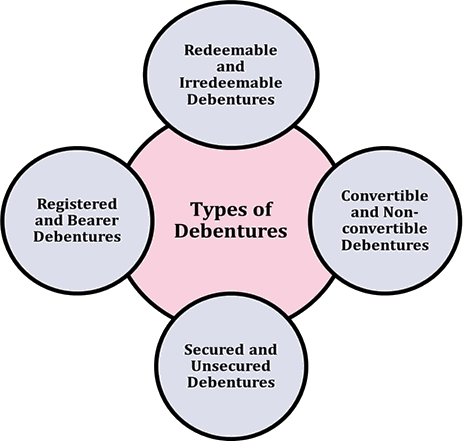

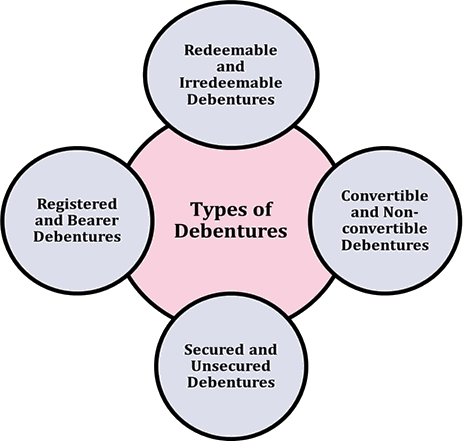

Types of Debentures

Debentures can be classified into various types based on their specific features, terms, and conditions. Here are some common types of debentures:

-

Convertible Debentures:

- Convertible debentures give debenture holders the option to convert their debentures into equity shares of the issuing company at a predetermined conversion ratio and price. These debentures offer the potential for capital appreciation if the issuer's stock price rises.

-

Non-Convertible Debentures (NCDs):

- Non-convertible debentures cannot be converted into equity shares and remain as debt instruments throughout their term. NCDs typically offer fixed or floating interest rates and provide regular interest payments to debenture holders.

-

Secured Debentures:

- Secured debentures are backed by specific collateral or assets of the issuer, providing additional security to debenture holders in the event of default. In case of default, secured debenture holders have a claim on the specified collateral to recover their investment.

-

Unsecured Debentures:

- Unsecured debentures, also known as naked debentures or simple debentures, are not backed by any specific collateral and rely solely on the general creditworthiness of the issuer. These debentures carry higher risk compared to secured debentures but may offer higher yields to compensate investors.

-

Fixed-Rate Debentures:

- Fixed-rate debentures pay a predetermined fixed rate of interest throughout the life of the debenture. The interest rate is determined at the time of issuance and remains constant regardless of changes in market interest rates.

-

Floating-Rate Debentures:

- Floating-rate debentures pay interest based on a variable interest rate that is tied to a benchmark rate (e.g., LIBOR) plus a spread. The interest rate adjusts periodically, typically semi-annually or annually, based on changes in the benchmark rate.

-

Redeemable Debentures:

- Redeemable debentures, also known as callable debentures, can be redeemed by the issuer before the maturity date at a predetermined redemption price. Issuers may exercise the call option to refinance debt, take advantage of lower interest rates, or adjust their capital structure.

-

Irredeemable Debentures:

- Irredeemable debentures, also known as perpetual debentures, do not have a maturity date and remain outstanding indefinitely. These debentures pay periodic interest payments to debenture holders but are not subject to redemption by the issuer.

-

Partly Convertible Debentures:

- Partly convertible debentures have a combination of both convertible and non-convertible features. A portion of the debenture can be converted into equity shares, while the remaining portion remains as non-convertible debt.

-

First Debentures:

- First debentures are issued with the first charge on the assets of the company. In case of liquidation, these debenture holders are paid before other creditors.

-

Second Debentures:

- Second debentures are subordinate to first debentures and are paid only after the claims of first debenture holders are satisfied in case of liquidation.

These are some of the common types of debentures available in the financial markets, each with its own features, benefits, and risks. Investors should carefully consider the terms and conditions of debentures before investing, taking into account factors such as interest rates, credit ratings, maturity dates, and conversion options.

Thank you,