Consumer And Wholesale Price Index

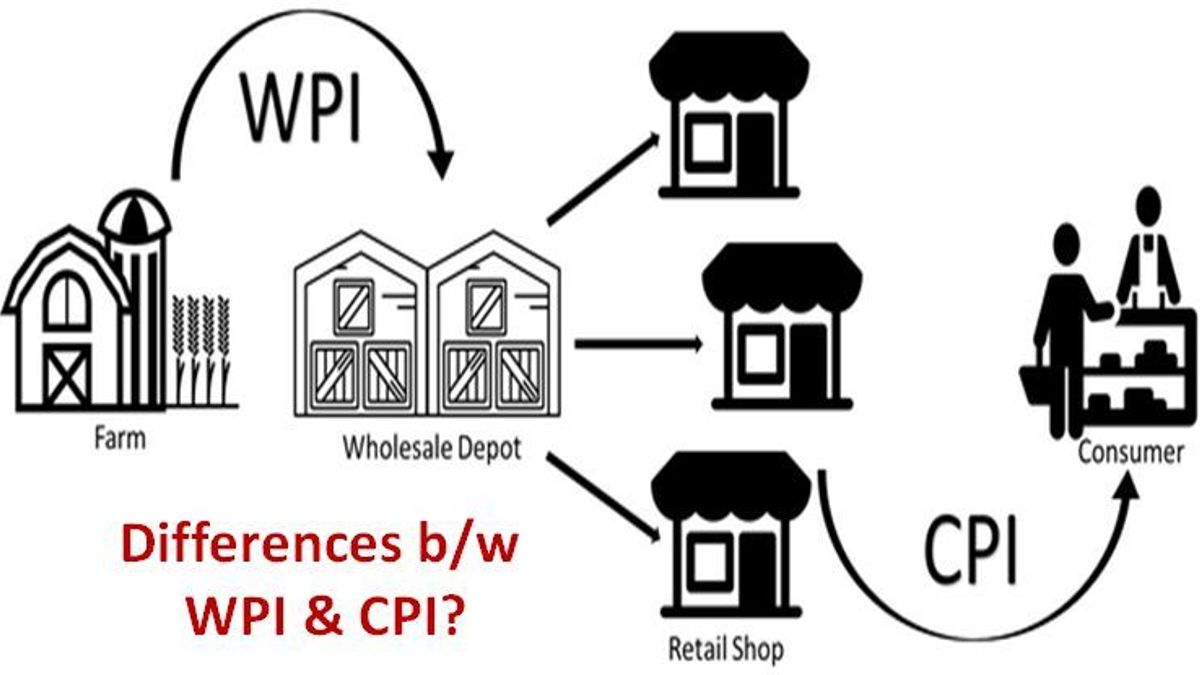

The Consumer Price Index (CPI) and the Wholesale Price Index (WPI) are two different measures used to track and analyze price changes in a basket of goods and services over time. They provide insights into inflationary trends and are essential economic indicators. Here's an overview of each:

Consumer Price Index (CPI):

Definition: The Consumer Price Index measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Composition: The CPI basket includes a variety of goods and services commonly purchased by households, such as food, housing, clothing, transportation, healthcare, and education.

Calculation: The CPI is calculated by comparing the current cost of the basket of goods and services to the cost of that same basket in a base year. It is expressed as an index number, with the base year assigned a value of 100.

Purpose: The CPI is a widely used indicator of inflation. It helps policymakers, economists, and the general public understand how the cost of living is changing over time.

Geographic Scope: CPI is often calculated for specific geographic areas, such as countries, regions, or cities.

Focus: CPI primarily reflects the changes in prices as experienced by consumers, making it a key measure for assessing the impact of inflation on households.

Wholesale Price Index (WPI):

Definition: The Wholesale Price Index measures the average change in the selling prices received by domestic producers for their output. It includes goods sold to retailers and other businesses, rather than directly to consumers.

Composition: WPI covers a broader range of goods than CPI and includes raw materials, intermediate goods, and finished goods at the wholesale level.

Calculation: Similar to CPI, the WPI is calculated by comparing the current cost of the basket of goods to the cost in a base year. The index is expressed as a percentage change.

Purpose: WPI is used to monitor price movements at the wholesale level and serves as an early indicator of inflationary pressures in the production and distribution chain.

Geographic Scope: WPI is often calculated for specific sectors or industries rather than for entire countries. Different indices may be calculated for manufacturing, mining, and agriculture.

Focus: WPI focuses on the prices faced by producers rather than consumers. It is a key measure for businesses to assess changes in production costs and make informed decisions about pricing and profitability.

In summary, while both the Consumer Price Index (CPI) and Wholesale Price Index (WPI) measure price changes over time, they do so from different perspectives – consumer spending for CPI and producer selling prices for WPI. These indices play crucial roles in economic analysis and policy formulation, providing valuable information about inflationary trends in an economy.

Thank you.