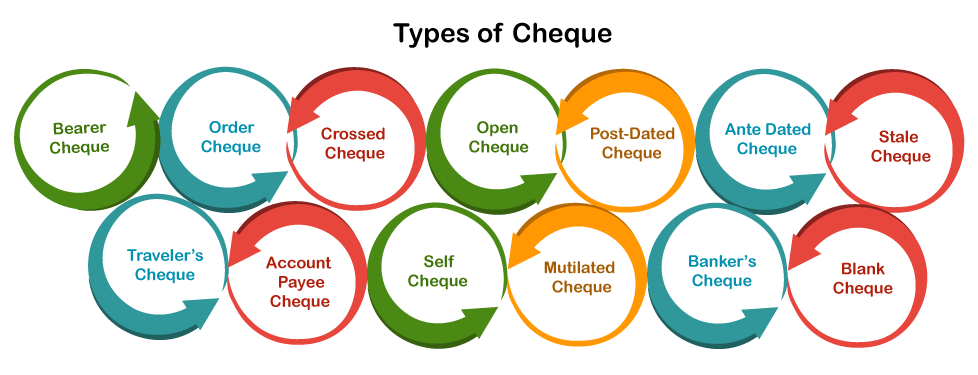

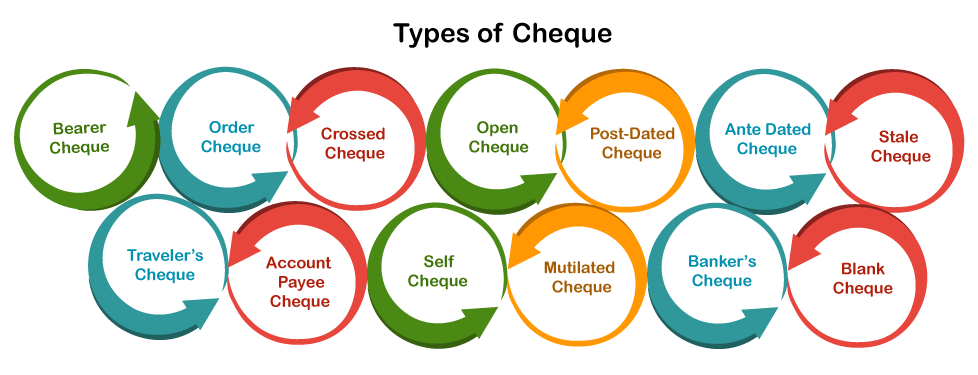

Different types of Cheques

Cheques come in various types, each serving different purposes in financial transactions. Here are some common types of cheques:

-

Bearer Cheque:

- Payable to the bearer, meaning the person possessing the cheque can receive the payment. It is a riskier form of cheque as it can be encashed by anyone.

-

Order Cheque:

- Payable to a specific person or organization. The payee must endorse (sign on the back of) the cheque to cash it or transfer it to another person.

-

Crossed Cheque:

- Contains two parallel lines across its face, indicating that the cheque can only be deposited into a bank account and not cashed over the counter. This adds a layer of security.

-

Open Cheque:

- A cheque that is not crossed, and the payment can be made over the counter at the drawee bank. It is considered less secure compared to crossed cheques.

-

Post-Dated Cheque (PDC):

- Bears a future date, and it is not payable until that date arrives. It is often used in situations where the issuer wants to delay payment until a specific time.

-

Ante-Dated Cheque:

- Bears a date earlier than the current date. However, this practice is generally discouraged as it may lead to legal issues.

-

Stale Cheque:

- A cheque that is not presented for payment within a specified period, usually three to six months. Banks may refuse to honor stale cheques.

-

Traveler's Cheque:

- A pre-printed, fixed-denomination cheque often used by travelers for safety and convenience. They can be replaced if lost or stolen.

-

Banker's Cheque (Demand Draft):

- Issued by a bank on behalf of a customer, guaranteeing payment. It is a secure form of payment, commonly used for large transactions.

-

Self Cheque:

- A cheque written by the account holder to themselves. It can be encashed over the counter or deposited into the account.

-

Non-Negotiable Cheque:

- A cheque that cannot be transferred to another person. It is used for specific purposes where the payment should only be received by the named payee.

-

Blank Cheque:

- A cheque that is not filled out with the payee's name or amount. It is a risky form of cheque as it can be misused if lost or stolen.

-

Gift Cheque:

- A cheque specifically designed for gift purposes, often issued by companies. It can be used for purchasing goods or services.

It's important to note that the availability and characteristics of these types of cheques may vary by country and banking regulations. Additionally, the usage of physical cheques has decreased in some regions due to the rise of electronic payment methods.

Thank you.