Bank Identifier Code

A Bank Identifier Code (BIC), also known as a SWIFT code, is a unique identification code assigned to banks and financial institutions worldwide. It serves as a standard format for identifying banks and financial institutions when conducting international transactions, such as wire transfers, in a secure and standardized manner.

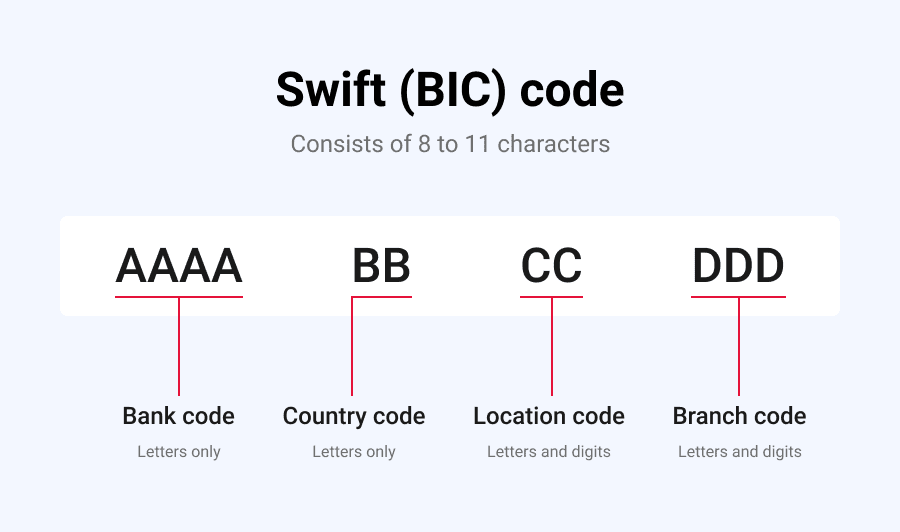

The BIC typically consists of either 8 or 11 characters and is structured as follows:

For example, a typical BIC may look like this: "ABCDUS33" or "ABCDUS33XXX".

BICs are used in international financial transactions to ensure accurate routing and processing of payments between banks and financial institutions across different countries. They are standardized by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which assigns and maintains BICs for financial institutions globally.

Thank you,